Are you tired of constantly feeling overwhelmed and uncertain when it comes to managing your investment properties? Are you dreading the next round of statements and emails from your property manager? Are you sick of not knowing who is managing your property? It’s time to take control of your property management experience!

Lets be honest, all investment properties require maintenance and yes, sometimes the unexpected happens. But if you’re dreading the next lot of statements and an email from your property manager has you gritting your teeth, take heart.

It doesn’t have to be that way!

We don’t promise unicorns and rainbows, but we do guarantee that our policies, procedures, and service make us stand out above the rest. With Meraki, you can step back, relax, and feel secure in the knowledge that we care about your property as much as you do.

Integrity. Initiative. Passion. Meraki.

We pride ourselves on our honesty and transparency, and have built amazing relationships with our clients that are built on trust. We manage every property as if it were our own, and it shows.

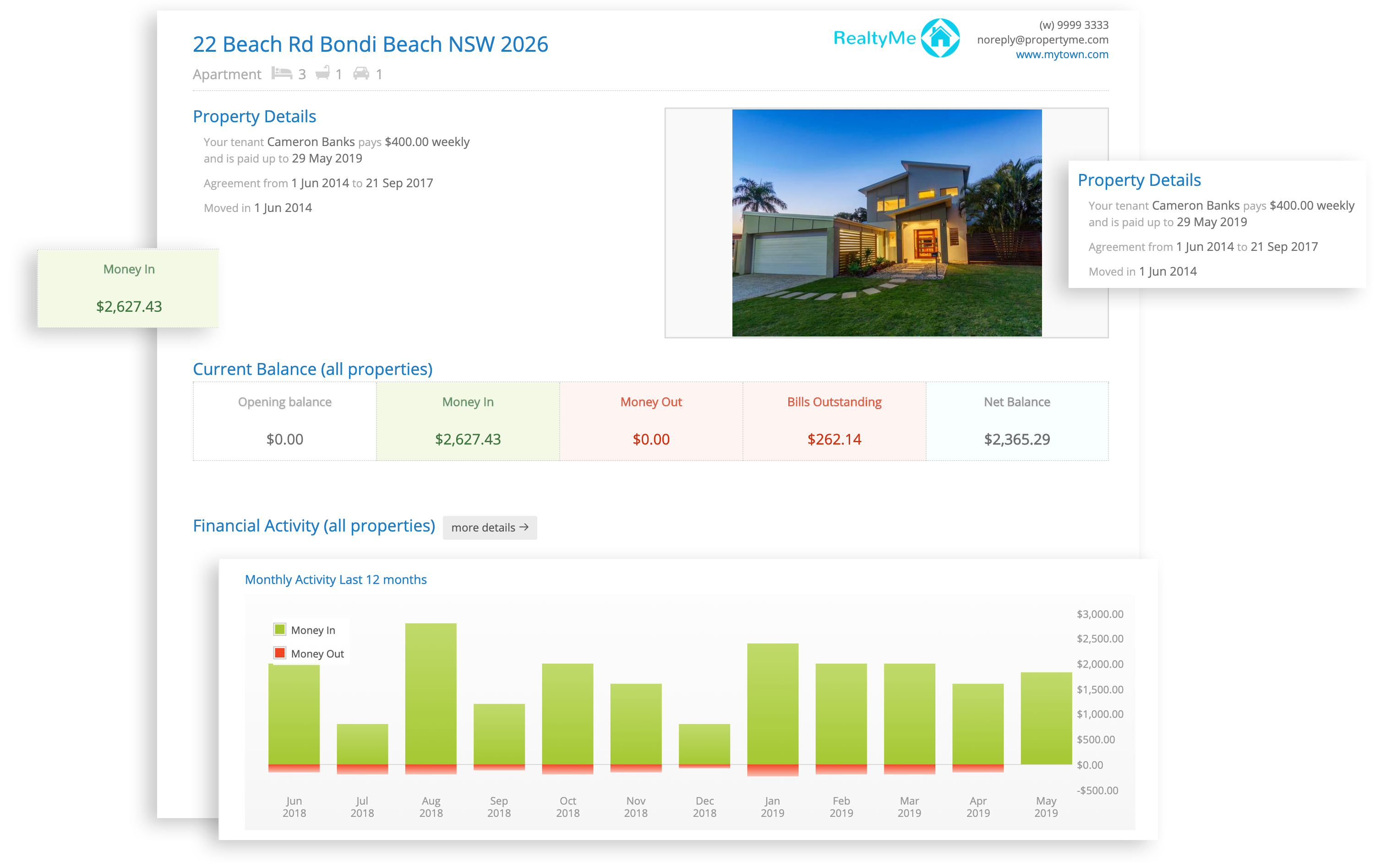

We offer our clients a superior customer experience with live, 24/7 access to their property information via our Owner and Tenant Portals

Owners can:

- See the current financial status of all their properties

- View photos and details of the property and tenancy

- Drill into financial activity

- Download historical statements, bills and documents

- Keep track of jobs and inspections

We have increased productivity with our workflow utilising our innovative system, which will increase value with your tenancy. Tenant’s are provided tools and resources to ensure that they are meeting their obligations at all time.

Gone are the days where tenants claim they ‘didn’t know’ they were in arrears or when their routine inspection is. With our system, we are eradicating the excuses and expectations are a higher standard of tenancy than ever before.

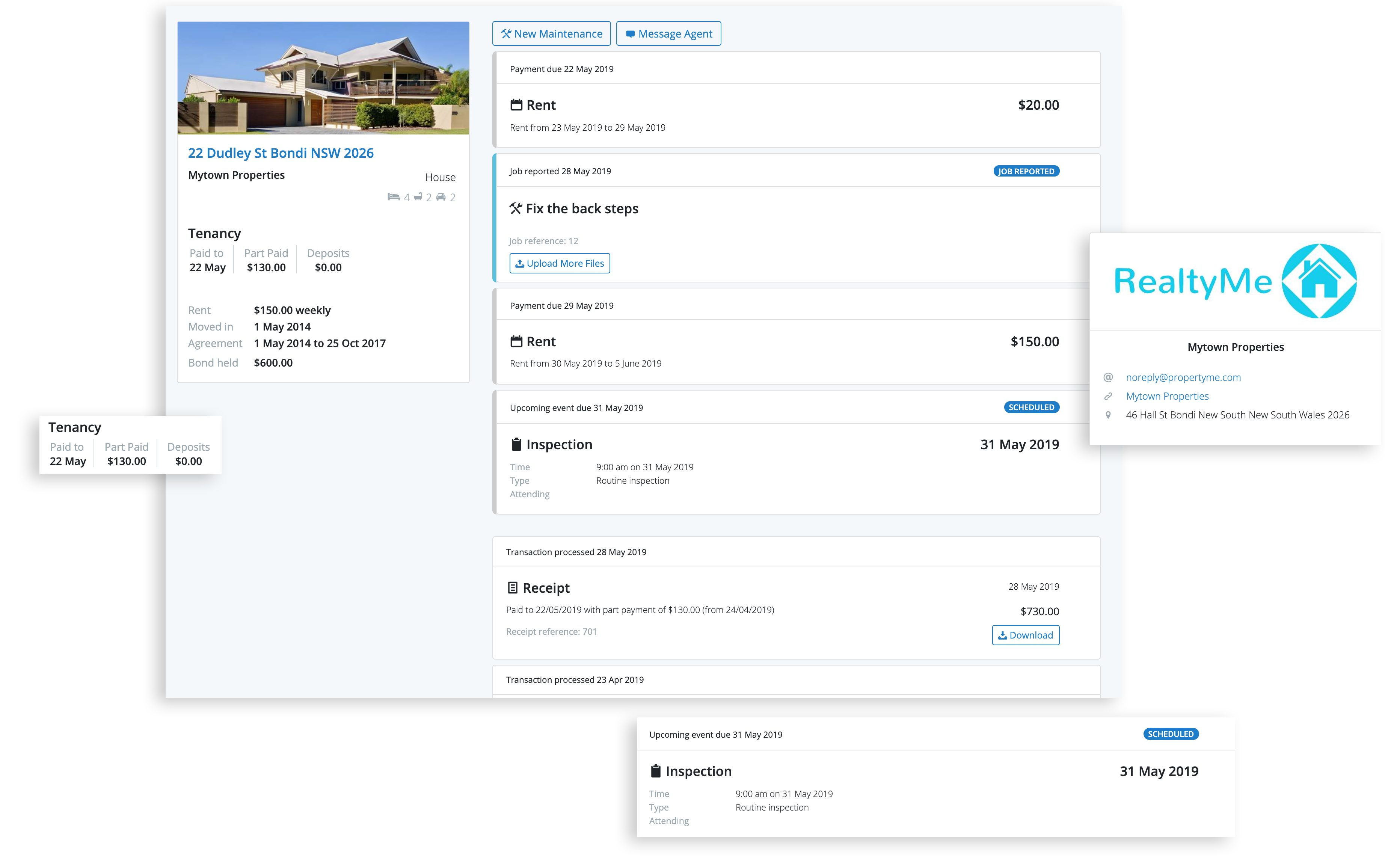

The Tenant Portal gives instant access to:

- View property and lease information

- See when rent and bills are due

- Log and monitor maintenance requests

- Message dedicated property manager directly

- Download rent receipts

- and much more!

Let’s Talk Fees.

More often than not, Owners get fed up with their property manager because they feel that their property is being mismanaged and costing them too much money. Once financially wounded, the search begins for a new managing agent, but the main focus becomes directed at the management fees, trying to recover costs.

We have a saying; ‘Buy it nice, or pay it twice!’ A ‘cheap’ property manager could end up costing you thousands of dollars over they year in lost rent, excessive costs and increase risk due to mismanagement.

If you’re looking for the cheapest property manager, we aren’t the one for you.

But if you’re looking for reasonable, comprehensive management fees for a property manager that is going to provide you with high quality service, has iron clad policies and procedures and genuinely cares for your property as if it were our own, get in contact with us.

If you don’t love us, leave us. No lock in contracts and no hard feelings!

At the end of the day, we want what is best for you and your investment property. If you believe that moving on to another managing agent is what is best, we will support your decision and ensure that all documentation and photos relating to your property and tenancy are passed on and work with your new agent for a smooth transition.