As the end of the financial year once again approaches… or passes us by (where did the last year go?), you will be starting to make preparations to complete your tax.

In June, we will reach out to let you know if you have any invoices that are within our system that require payment, and let you know the amount needed to ensure they are paid before the 30th; so you can allocate these costs towards your tax assessment. If there is no urgency for you in having these invoices paid before the end of the month, there is no requirement for action.

We will guide you through where to locate any missing pieces you may need for your records and tax assessment, as well as provide some quick tips on what you may be able to claim on your tax.

WHAT CAN YOU CLAIM ON YOUR TAX?

There are a number of things that you can and cannot claim during your Tax Assessment relating to your investment property, and it is always in your best interest to seek the advice of your accountant on these matters. However, we have a quick list and some resources from reputable Australian content creators who may be able to assist you with understanding what can be claimed during tax time.

A QUICK LIST:

- Rental Expenses:

- Property Management Fee

- Letting Fee (including Advertising Fee)

- Interest paid on your Mortgage

- Rates:

- Water Rates

- Council Rates

- Any Repair and Maintenance *

- General Maintenance

- Repairs

- Pest Control

- Cleaning

- Tax Depreciation Schedule

- Insurance:

- Building

- Landlord & Contents **

- Legal & Tax:

- Legal Advice

- Tax Advice

- Land Tax

* Conditions may apply, such as property requiring to be tenanted during time of works being completed – refer to advice from your tax agent.

** Conditions may apply – refer to advice from your tax agent.

For more information about Tax Depreciation and Property Maintenance Schedules, please visit our blog post.

Content created by: Belinda Botzolis (@thevaluer)

ACCESSING STATEMENTS & INVOICES

You can view, download or print current and historical statements, attached bills and general scanned documents from your Owner Portal.

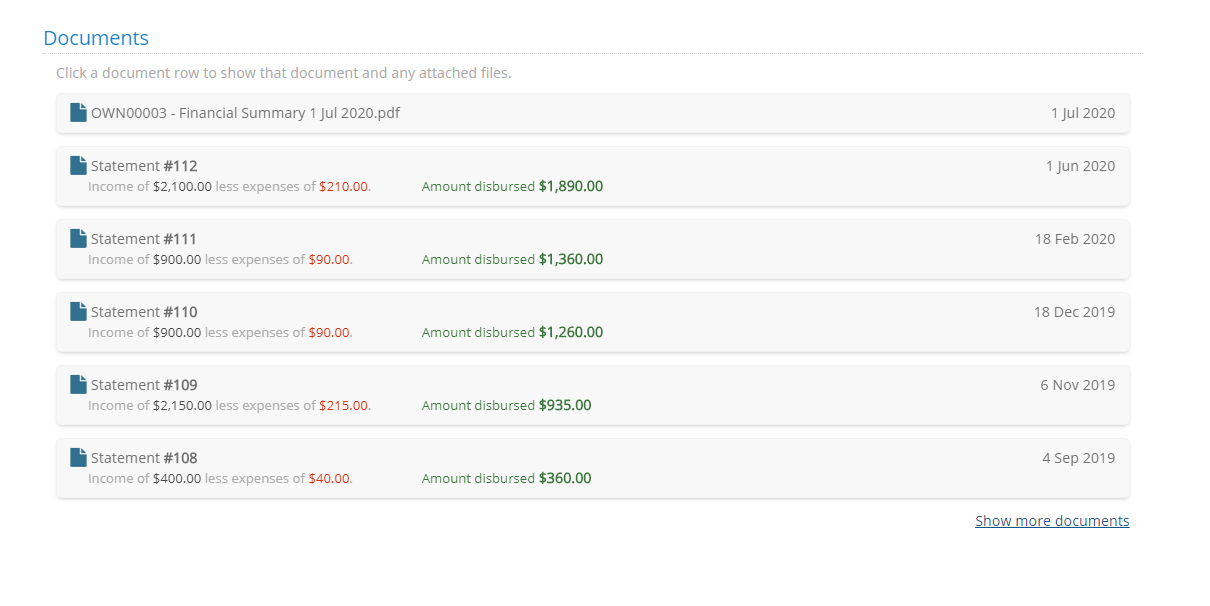

Statements and Tenancy Documents are located in the Documents section. If you are unable to find the statement required, please ensure you click ‘Show more documents’.

A copy of all Statements that have been emailed to you can be viewed and downloaded as a PDF, as well as Paid Invoices/Bills for that statement period. You can easily determine the Statements that have invoices attached when the Expenses value (in red) is higher than your standard management fee.

A copy of all past EOFY Statements that have been emailed to you are available for download also and show as ‘Financial Summary’.

UNDERSTANDING YOUR STATEMENT SCREEN

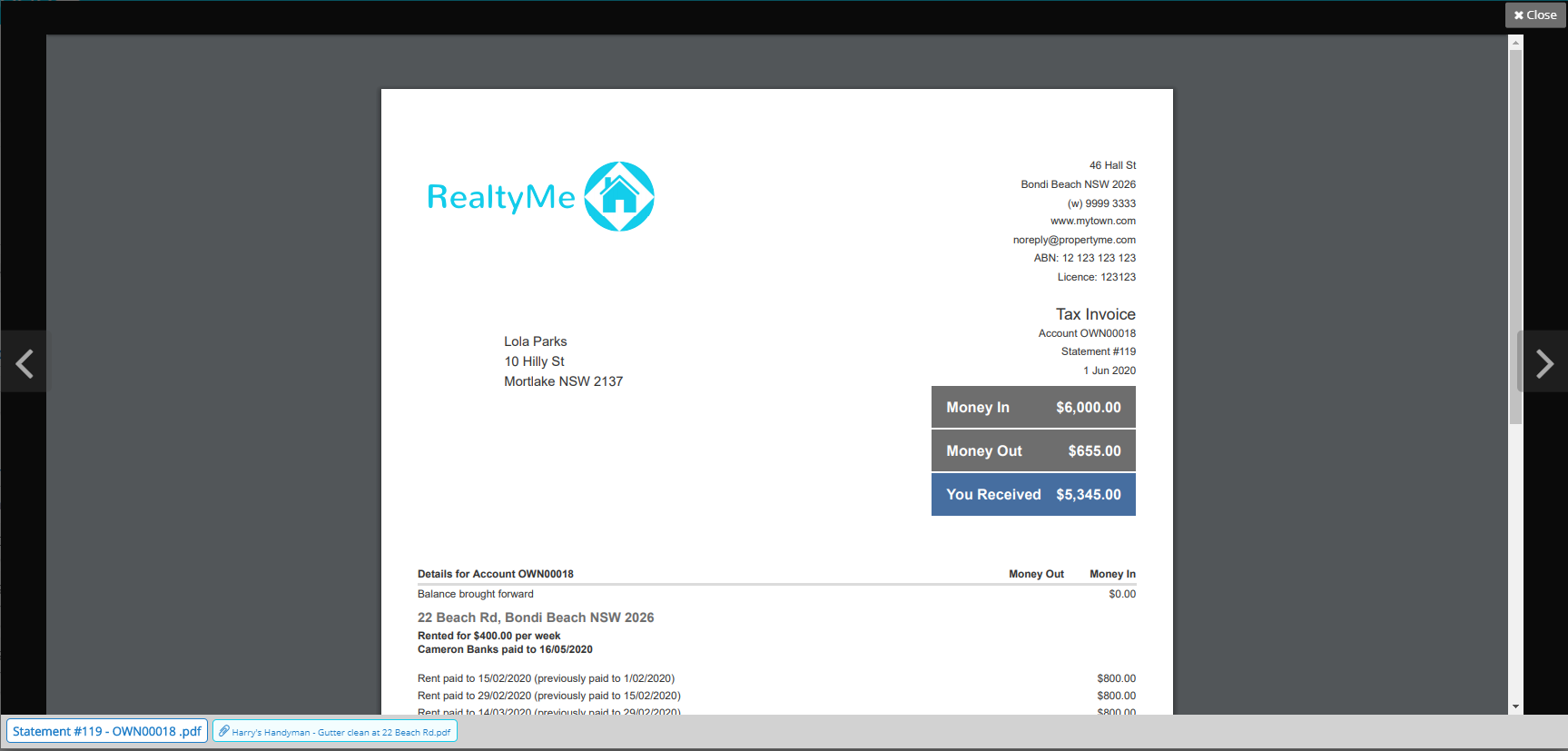

When selecting a Statement, the a new window will open giving you the option to print or download. Statements that have invoices that were paid during that statement period will have them attached at the bottom of the window, and will show as a separate ‘tab’.

Below image is an example of the Statement window with the additional attachment in the bottom grey panel, showing

EOFY STATEMENTS (Financial Summary Reports)

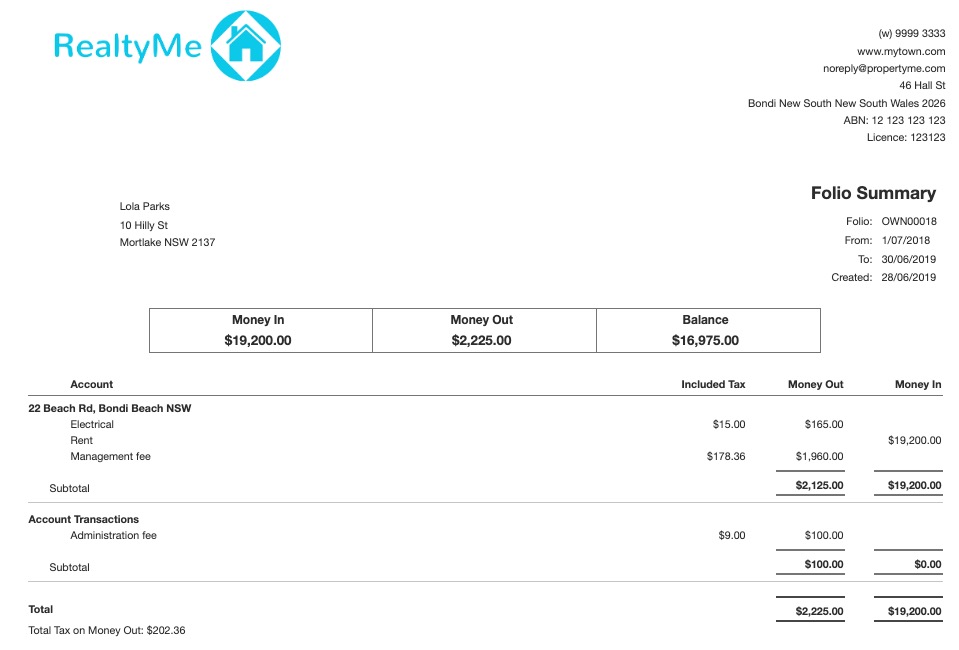

Financial Summary Reports can be created and sent at any time of year. However, they are more widely used at the end of a Financial Year when Owner’s are looking for the break down of income and expenses for each property.

The financial summary report groups the income and expenses of each property by Account. Then, presents it in an easy to read format.

There are two ways to outline transactions on your financial summary statements, it’s either by transaction date or statement date method. Meraki Property Management have elected to use TRANSACTION DATE Method.

TRANSACTION DATE

This method will include any transaction that fits within the selected date range.

Transaction date is the more commonly used way of reporting. It will include all transactions that fall into the selected date range.

If you choose the 1/7/2018 to the 30/6/2019 then all transactions that have happened between those dates will be included.

PROs

Includes all transactions that occurred between the dates ranges 1/7 to 30/6

CONs

Generally will not match the statements to your owners as there are almost always transactions before or after an owner disbursement that don’t exactly fit into the date range of 1/7 to 30/6.

Example below:

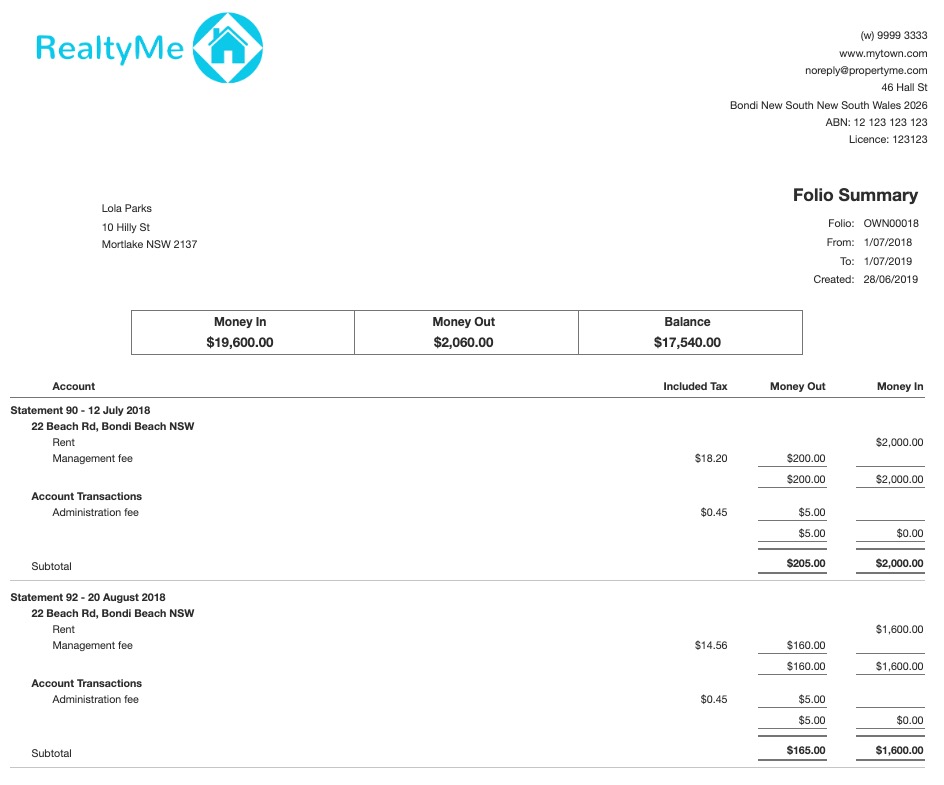

STATEMENT DATE

The Statement Date method will include all transactions on the statements for the selected date range.

It is not concerned about the date of the individual transaction, it is looking for the date the statement was generated.

Generating reports this way will match your folio summary reports exactly to the totals on your owner statements.

When you select to group them ‘By Statement‘ in Options, they will appear by statement order and broken down that way.

Matches the folio summary exactly to the transactions you have paid to your owners

Example below:

Disclaimer: information and resources provided within this post are provided in good faith and are not professional advice. For all matters relating to your End of Financial Year tax requirements, please speak with a qualified Tax Accountant.