As managing agent, it is our duty of care to not only advise you on potential risks, but also provide information and help you reduce risks wherever possible.

Whilst every care is taken in managing your investment, life changes affect people and could affect your tenant’s personal situation in the future.

This may mean due to unexpected events such as relationship breakdowns, domestic violence, job loss, financial stress and other social issues, the tenant may find themselves in a difficult situation which could impact financial upon you as an investor.

Our agency recommends our clients have Landlord Insurance as part of a sound risk strategy for your investment.

HOWEVER, not all insurance policies are the same.

A majority of the time, insurance providers have small print and exclusions that result in a majority of common tenancy issues not being covered in the policy.

An example of this: pet damage is generally not covered, as well as the difference between ‘flash flooding’ and ‘rapid flooding’. Several home owners and tenants who were affected by the 2019 Townsville Flood Event fell victim to this fine print in their insurance policy.

When looking for a landlord insurance policy, important considerations should be the cover offered and the amount of excess you are required to pay should you ever have to make a claim.

Price alone shouldn’t be the only deciding factor – the old adage of getting what you pay for can apply to insurance as much as any other product.

Peace of mind comes with knowing that the things most important to you will be covered in the event of a claim – along with knowing that your payment won’t be eroded by high excesses.

In addition to traditional insurances, we also recommend subscribing to Barclay MIS Protect and Collect.

There are 4 main areas of cover for landlord insurance:

WHO DO WE RECOMMEND?

Terri Scheer – the Landlord Insurance Specialists

In all of the years that we have worked with Owners and their Insurance Agencies, there is only one that stands out above the rest – Terri Scheer. We have found them to be the fastest to act on a claim, most reasonable in relation to excess costs and have a high payout approval.

The Terri Scheer Landlord Preferred Policy provides cover for permanently tenanted properties, including:

- Loss of rent

- Loss or damage – Contents (including floating floorboards)

- Loss or damage – Building (tenant damage)

- Tax Audit

- Legal Liability

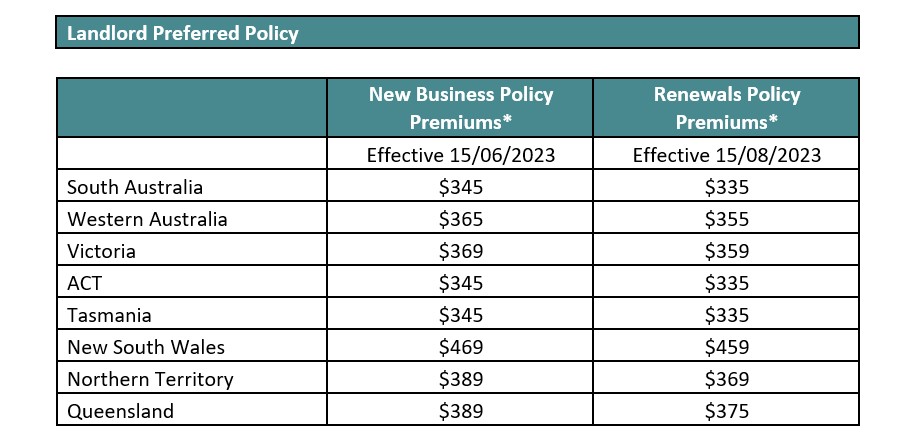

Queensland Policy Premium: $389*

Weekly rent limited to $1000 within standard premium. *Pricing subject to change

Many Real Estate Agents have been appointed as Distributors for Terri Scheer Insurance products and are able to arrange insurance on our behalf. Disclaimer: although Terri Scheer is our preferred Landlord Insurer, Meraki Property Management are in no way affiliated with Terri Scheer or sister companies.

Alternatively, cover can be placed online at terrischeer.com.au or by phoning Terri Scheer Insurance on 1800 804 016.

Save 10% of costs with Terri Scheer’s Combined Coverage

Download: Terri Scheer – Landlord Preferred Policy Application

Download: Terri Scheer – Landlord Residential Building Insurance